Over 4.5 million fans entered FIFA’s Visa presale lottery, but just 1 million tickets emerged—many at sticker-shock prices, including $4,210 for the World Cup Final’s upper deck. The real story? A shift in tactics: dynamic pricing, uncapped resale, and dual-sided fees are redefining the global fan experience, turning the 2026 tournament into both a revenue machine and a potential accessibility crisis.

Tactical Framework

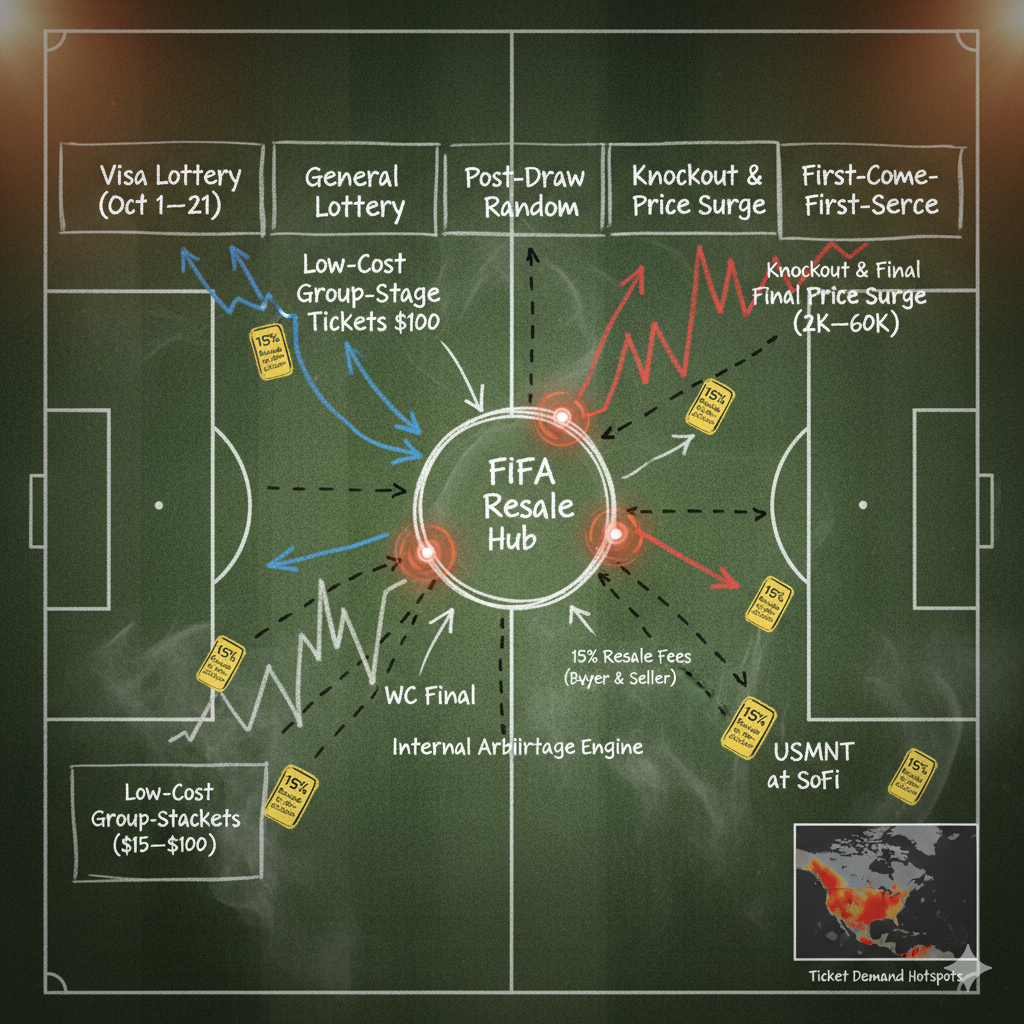

FIFA’s ticketing strategy for the 2026 World Cup follows a four-phase sales formation, built to balance hype, demand, and profit:

- Base Formation: A 4-3-3 structure of presale waves: Visa lottery → general lottery → post-draw random phase → first-come-first-serve, all underpinned by dynamic pricing.

- Key Roles:

- Lottery as high-press defense against scalper overload.

- 15% resale fees as the double pivot—charging both sellers and buyers.

- Uncapped pricing as FIFA’s attacking press to extract maximum yield.

- Build-Up Structure: Phase 1 (Oct. 1–21) emphasizes controlled entry and base pricing, with phases 2–4 expected to unleash volatility.

- Adjustments: Unlike previous tournaments, this model adopts a U.S./Canada-style resale logic, with no price caps; however, platform control ensures FIFA receives a cut.

Three Tactical Highlights

The Lottery Press: Shielding Supply in a 4.5M Crowd

To blunt the scalper advantage, FIFA’s opening salvo was a random draw—4.5 million fans queued digitally, hoping to land just 15–20% of the whole inventory. Some reported wait times exceeding two hours, despite “Almost there…” screens.

- Key Data: 4.5M applications, ~1M tickets released in Phase 1.

- Tactical Concept: The lottery acts like a high defensive line—limiting early access while stretching anticipation until Oct. 21.

This softens backlash by delaying rejections and keeps demand artificially inflated for the next sales wave.

“With dynamic pricing and fee-loaded resale synced, FIFA gears up for a profitable knockout stage—but at what cost to the global party’s soul?”

💸 Dynamic Midfield Rotations: From $60 Floors to $6K Ceilings

FIFA’s pivot to variable pricing mirrors modern inverted fullbacks: appearing cautious but surging unpredictably.

- Example: Category 1 tickets for the Final soared to $6,730—nearly 10x 2022’s mid-range options.

- USMNT Opener at SoFi: $2,735 (Cat. 1) vs. $680 inflation-adjusted for 2022.

- Secondary Listings: Already topped $10,000 for marquee games.

Prices appear calibrated for yield, not inclusivity—reminiscent of the Super Bowl, not the World Cup’s traditionally broad fan base. It's simply how Americans value exclusivity in Sports. Supply and Demand at its peak.

Scalping? More like creating an economic market for the biggest game in the sport so it doesn’t get eaten up by influence. This is such a part of the 🇺🇸 culture. Why the outrage?? Embrace it. https://t.co/DRSbMel76b pic.twitter.com/6bqg0ammZi

— Celso Oliveira (@celsoliveira_) October 3, 2025

🔁 Uncapped Resale Engine: Fees as the Double Pivot

FIFA’s uncapped resale model is a bit greedy—and profitable. When it charges 15% to both sellers and buyers, the organization acts as both pivot and distributor in the resale market – FIFA wants pricing to go up since they're in for a percentage of the inflated amount.

- Oct. 2 Launch: Tickets were flipped within hours, sometimes for three to five times face value.

- Contrast: The 2025 Club World Cup had ticket prices drop to $13 due to poor demand control.

Without hard caps, resale will likely widen the affordability gap, but it also ensures FIFA capitalizes on every scalped pass.

Victory Lap or Own Goal?

With dynamic pricing fully activated and a built-in fee engine, FIFA is poised to $1B+ in ticketing revenue alone. However, as knockout-stage demand spikes after the December 5 draw, everyday supporters risk being priced out of their own party.

- Repeatable Strategy? Almost certainly—for FIFA and future mega-events.

- Risks? Backlash, empty seats, and further eroding of the “global festival” ideal.